As 2025 draws to a close, Dubai’s real estate market continues to demonstrate resilience, adaptability, and long-term growth. The final quarter of the year, October through December, presents a golden window for investors looking to capitalize on seasonal opportunities, upcoming global events, and strong economic fundamentals. Here’s why the closing end of 2025 could be the smartest time to make your move in Dubai real estate.

Year-End Developer Incentives

The last quarter of the year often sees developers pushing hard to close sales before year-end. This urgency translates into highly attractive offers, including flexible payment plans, waived service charges, reduced booking fees, and even furnishing packages. Investors who step in during Q4 frequently benefit from deals that are less common in the busier months of the year.

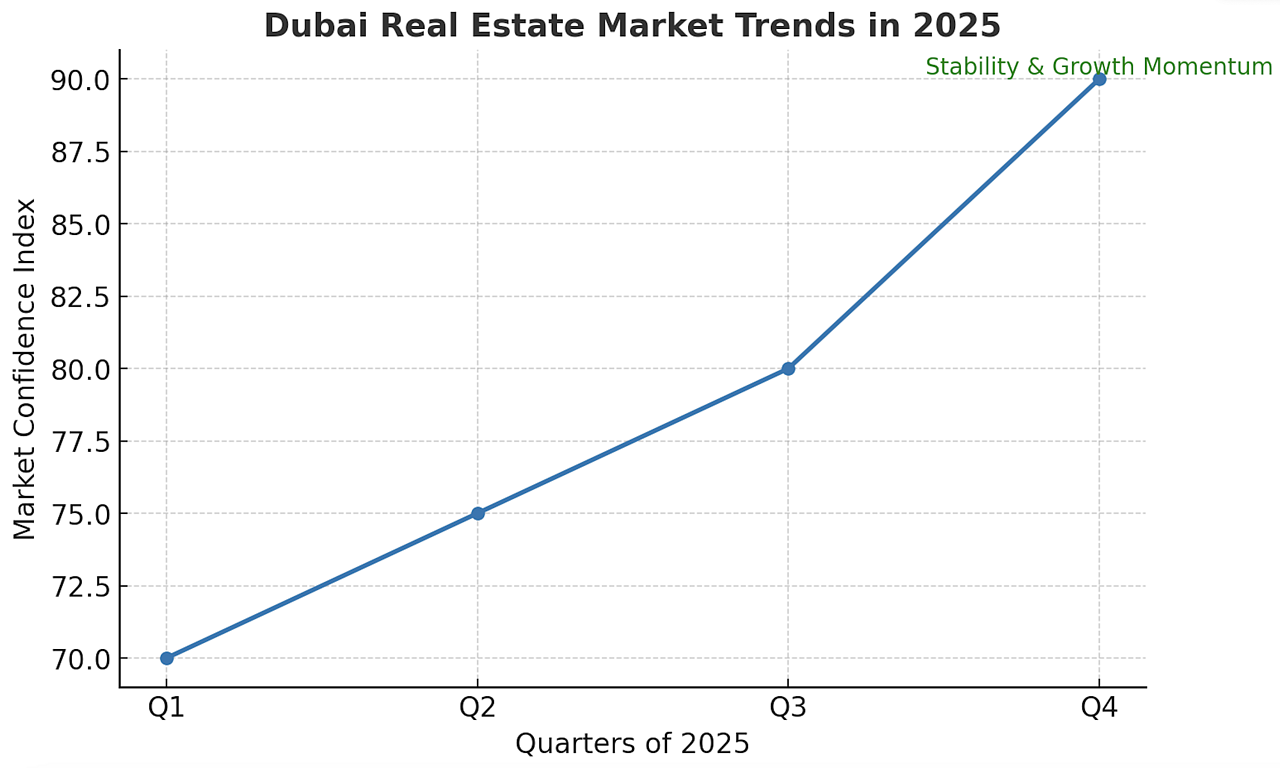

Market Stability and Growth Momentum

By Q4, the market has absorbed the activity of the year, creating clearer trends in pricing and demand. Investors entering at this point have the advantage of reviewing annual performance data to make more informed decisions. With Dubai’s real estate market continuing its upward trajectory in 2025, year-end becomes a time when buyers can enter with confidence, knowing they are building on sustained momentum rather than speculation.

Prime Rental Positioning for 2026

Purchasing property in late 2025 positions investors perfectly to take advantage of Dubai’s annual surge in rental demand at the start of the new year. Many expatriates relocate in January, making it one of the busiest rental periods in the city. By investing in Q4, landlords can prepare their properties, whether off-plan or ready-to-move-in, for maximum returns in early 2026.

Off-Plan Opportunities in Emerging Communities

Dubai’s off-plan sector continues to thrive, with new launches in high-growth areas like Dubai South and Meydan. By Q4, several of these projects are expected to hit the market, often with investor-friendly entry points and payment structures. Those who commit at launch can capture long-term appreciation as the city expands its infrastructure and lifestyle offerings in preparation for major global events in the coming years.

Golden Visa Advantage

The UAE’s 10-year Golden Visa remains a strong driver of real estate investment. Properties valued at AED 2 million and above still qualify buyers for this long-term residency option, which is especially appealing to international investors seeking stability and a secure base in Dubai. Entering the market during the quieter end-of-year season often means less competition for prime units that meet Golden Visa thresholds.

Strategic Timing With Global Buyers

The final quarter is also a time when international investors, particularly from Europe and North America, flock to Dubai as the weather cools and global travel picks up. This influx not only stimulates demand but also validates Dubai’s continued status as a global real estate hub. For local and early investors, Q4 offers the chance to act before international demand further drives up competition in 2026.

A Market That Rewards Early Movers

Dubai has consistently rewarded those who enter the market ahead of major waves of activity. The close of 2025 represents a sweet spot, developers are eager to close their annual books, rental demand is just around the corner, and long-term fundamentals remain strong. Savvy investors who position themselves now will be well placed to maximize both capital appreciation and rental yields heading into the new year.

Don’t Wait Until 2026

While some investors may wait for January to start their search, those who act in the final months of 2025 gain early access to deals, incentives, and inventory that may not be available later. With Dubai’s market expected to remain one of the most dynamic globally, the closing end of 2025 is your chance to enter at the right time, with the right advantages, before competition intensifies.