Every starting needs planning, planning needs understanding, understanding needs guidance, and here is the ultimate guide to Dubai Real Estate Investment Strategies to start investing. Real estate investing for beginners requires understanding key strategies to set them on a path toward long-term success.

Dubai welcomes a record 9.31 million visitors in H1 2024, and more investments are planned as Dubai sees 23-25 million visitors by 2025. The city is home to 3.8 million now, and that’s expected to surge to 5.8 million by 2040. As the visitors and population grow the investment will also surge in a limited time. UAE is the second-largest recipient of FDI and ranked in FDI inflows in West Asian Countries and MENA Region. The real estate market in the United Arab Emirates is strong and more yielding in Dubai and Abu Dhabi.

Here are the outlines of important real estate investment strategies and tips, with an emphasis on the Dubai market.

Understanding Dubai Real Estate Investment

Real estate can provide investors with numerous investment options depending on their financial goals. First, get to know the property types and investment types. Common strategies for beginners include direct ownership of rental properties, house flipping, real estate investment groups (REIGs), real estate investment trusts (REITs), and online real estate platforms. Each one of these strategies has its pros and cons that range from management to passive income options.

- 1. Off-Plan Vs. Ready Property Investment:

Off-plan homes (those in construction) are usually available for sale at a lower cost and come with flexible payment plans that offer greater potential for appreciation after the project’s completion. However, they are also subject to certain risks, like delays to the construction. The ready properties can be rented in a matter of minutes, allowing immediate cash flow, but they may have a higher cost at a certain point.

- 2. Market Cycles and Timing:

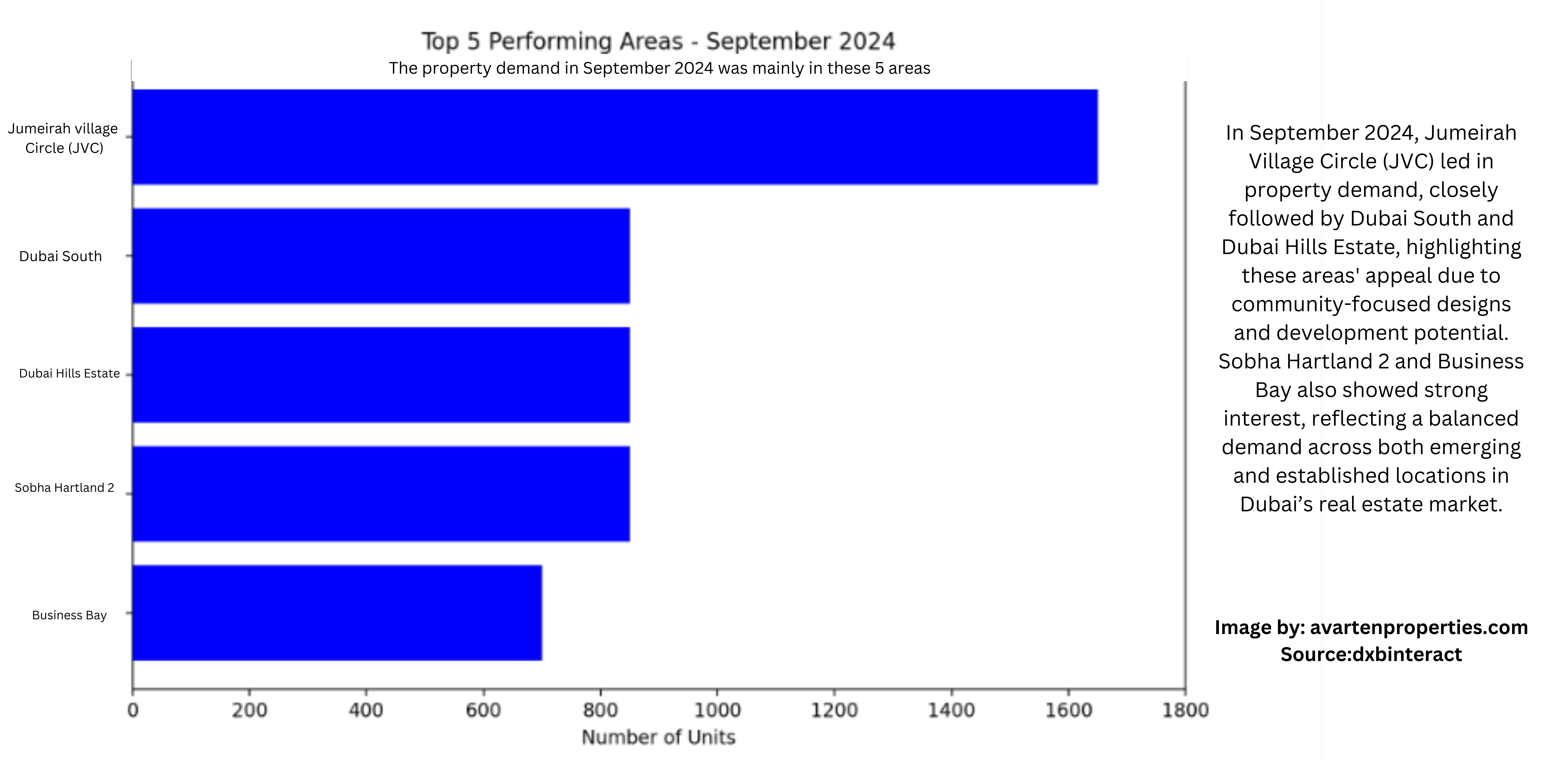

The Dubai property market is seasonal, with fluctuation in prices due to demand, supply, as well as economic variables. As an example, events such as Expo 2020 caused an increase in demand, but after the Expo the market reacted. Monitoring these cycles and trying to purchase during a low-cost period can boost investment returns. Having a track of every month’s sales is also crucial.

Source: https://dxbinteract.com/

- 3. Freehold and Leasehold Zones:

Dubai offers both freehold and leasehold zones, each one having its own rules and benefits. Freehold zones permit expats to own their property completely which makes them attractive for long-term investments. Leasehold zones, on the contrary, provide ownership rights for up to 99 years. Knowing the difference is crucial when deciding on a property investment.

- 4. Direct Ownership of Rental Properties

Owning rental properties is one of the oldest and most reliable ways of investing in real estate, offering steady cash flows from rental income as well as potential property appreciation benefits. Direct ownership may prove particularly lucrative in cities like Dubai where property values experience consistent appreciation; however, management costs and upfront expenses may present challenges.

- 5. Flipping properties

Property flipping is an ideal investment strategy for those seeking quick returns by purchasing, renovating, and selling properties quickly for a profit. Though this strategy offers high potential returns in Dubai’s fast-paced market, success requires an in-depth knowledge of local Dubai real estate market conditions, renovation costs, and risk management practices – beginners should take caution due to capital capital-intensive nature of house flipping. Real Estate Investment Groups (REIGs) offer another alternative as these pools pool money from multiple investors together to manage real estate properties while remaining hands-off – perfect for diversification without direct involvement with property management!

- 6. Real Estate Investment Trusts (REITs)

REITs provide beginners with an easy entryway into Dubai real estate investing through a stock-like structure. REITs own and manage real estate assets on investors’ behalf, then distribute dividends from income generated. REITs may offer exposure without direct property management obligations – however, their value can fluctuate as with stock markets compared to direct ownership options which offer more control.

- 7. Real Estate Platforms

Real estate platforms such as Avarten Invest in Dubai provide investors with an affordable way to participate in large-scale real estate projects with minimal upfront investments, often connecting investors directly with developers and allowing for geographic diversification.

- 8. Research the Local Market

Dubai’s real estate market is highly dynamic, providing investors with many investment opportunities across residential, commercial, off-plan, secondary, and luxury segments. Knowledge of neighborhoods such as Dubai Marina, Jumeirah Lake Towers, and Palm Jumeirah is vital in making informed investment decisions.

When investing in Dubai, it’s crucial to focus not only on established areas but also on emerging neighborhoods. Locations like Dubai South are gaining significant attention due to increased development and the impact of the new Dubai airport, which is driving up property demand and prices. Similarly, the Ras Al Khor area is on the rise, with major projects from Sobha, Meydan, and Emaar set to transform the landscape. Understanding both current and upcoming areas is essential for making informed investment decisions and maximizing potential returns.

- 9. Focus on Growth

While flipping can yield short-term profits, real estate can often be seen as an investment with long-term potential. Focusing on properties with strong appreciation potential and steady rental income may lead to more sustainable returns over time. One of the main draws to investing in Dubai is its tax-free environment, making property investment even more appealing. Leveraging this advantage can increase returns from rental income and property appreciation alike.

- 10. Real Estate Investing Maximizing Returns

Beginners looking to maximize returns should match their investment strategy with their financial goals, such as renting properties that provide long-term stability or flipping them for faster returns, which requires greater market knowledge. REITs and REIGs offer diversification with less involvement than direct investing, while online platforms enable investors to make smaller initial investments and diversify geographically.

Real estate investing in Dubai presents many opportunities for newcomers. Ranging from hands-on tactics such as house flipping and direct ownership to more passive strategies like REITs, REIGs, and online platforms – each has its strategy that fits a person’s risk tolerance and long-term goals. Successful real estate investments are within reach with proper planning, research, and focus on long-term growth

Traditional vs. New Investment Opportunities in Dubai

In Dubai’s real estate market, traditional investment has often involved purchasing properties directly from developers. This method provides investors with physical assets, usually in the form of residential or commercial spaces, allowing them to own property outright and gain potential long-term value appreciation. Traditional real estate investment is a well-known approach that many investors rely on for building equity over time. However, it requires substantial capital and hands-on management, from dealing with maintenance and tenant issues to navigating market fluctuations. While this conventional route provides solid returns, it can be resource-intensive and time-consuming.

The new wave of investing in Dubai, particularly with platforms like Avarten Invest, offers a modern solution to owning property without the same level of commitment and management. Through fractional ownership, investors can buy shares in large off-plan projects, becoming co-owners of high-value real estate assets. This approach allows for investment in upscale developments without needing the extensive capital required for outright ownership, enabling investors to diversify their portfolios with ease. Additionally, it offers a seamless experience where they simply invest and watch their money grow, with no need to actively participate in property management. This innovative method not only makes high-end property ownership more accessible but also provides stable returns, presenting a safe, efficient, and hassle-free way to invest in Dubai’s booming real estate market.