Dubai, one of the world’s most sought-after real estate markets, offers a variety of financing options for those looking to invest in property. Whether you’re a local resident, an expat, or a foreign investor, there are several ways to finance a property purchase in this thriving city. In this article, we’ll break down three common financing methods: traditional mortgages, cryptocurrency, and cash purchases, each with its own benefits, requirements, and considerations.

1. Financing with Mortgages in Dubai

A mortgage is the most common method of financing a property in Dubai. Whether you’re purchasing a home for personal use or an investment property, local banks and financial institutions offer a wide range of mortgage products.

Types of Mortgages Available:

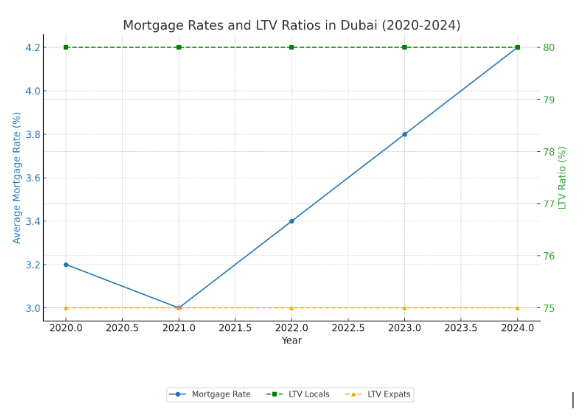

- Traditional Mortgages: These are the most common and typically offer competitive interest rates. The maximum loan-to-value (LTV) ratio for expats is 75% for properties worth less than AED 5 million, and for UAE nationals, it can be up to 80%.

- Islamic Mortgages: For those looking for Sharia-compliant options, Islamic banks provide products such as Murabaha (cost-plus financing) and Ijara (lease-to-own).

- Off-Plan Mortgages: For off-plan properties, banks often offer a payment plan that allows you to pay in installments during the construction phase, with a lump sum due at handover.

Statistics on Mortgage Market in Dubai (2024):

- According to the UAE Central Bank, residential property prices in Dubai rose by 10% in 2023. As a result, demand for mortgages has seen an increase, particularly among foreign investors looking to tap into the market.

- The average mortgage rate in Dubai for 2024 is approximately 3.5% to 4.5% annually.

- Data from Property Finder suggests that 55% of property buyers in Dubai use mortgages for residential purchases, while investors often prefer to use mortgages for higher-yielding rental properties.

Statistics on Mortgage Market in Dubai (2024):

- Lower Upfront Payment: With the right mortgage, you only need a small deposit (around 20-25%) upfront. This allows you to retain more of your capital for other investments or expenses

- Leverage to Maximize Returns: By using a mortgage, you can leverage borrowed money to purchase a larger or more valuable property, potentially increasing your return on investment.

Mortgage rates in Dubai from 2020-2024 and how LTV ratios differ for locals and expats.

Considerations:

- Debt Serviceability: Ensure that you can comfortably meet the monthly repayments. Dubai lenders usually assess your ability to service the debt based on your income, making sure you don’t overextend yourself.

- Interest Rates: While the rates are competitive, they can fluctuate, especially for variable-rate mortgages. Locking in a fixed-rate mortgage might be a smart choice for long-term stability.

2. Financing with Cryptocurrency

As cryptocurrency continues to gain popularity, some Dubai-based developers and property sellers are now accepting digital currencies, such as Bitcoin (BTC) and Ethereum (ETH), as a means of payment. While this is not yet widespread, it represents a growing trend toward alternative financing options.

The Rise of Crypto in Dubai’s Property Market:

As cryptocurrency continues to gain popularity, some Dubai-based developers and property sellers are now accepting digital currencies, such as Bitcoin (BTC) and Ethereum (ETH), as a means of payment. While this is not yet widespread, it represents a growing trend toward alternative financing options.

- Dubai’s Crypto-Friendly Regulations: Dubai is increasingly known for being a crypto-friendly destination, with the Dubai Financial Services Authority (DFSA) introducing regulations that aim to boost the crypto market in the UAE. This makes it an attractive place for crypto investors looking to diversify their portfolios into real estate.

- Developers Accepting Crypto: Prominent developers like Damac and Omniyat have started accepting cryptocurrency for property transactions, making it easier for crypto enthusiasts to convert their digital assets into tangible investments

Advantages of Paying with Crypto:

- No Conversion to Fiat Currency: Buyers using cryptocurrency can avoid the process of converting their digital assets into fiat currency (e.g., AED or USD), which can incur additional fees.

- Global Transactions: Crypto allows for borderless transactions, making it easier for international buyers to enter the Dubai real estate market.

- Potential for Capital Appreciation: If the value of your cryptocurrency increases over time, it can lead to significant appreciation in your overall investment portfolio.

Considerations:

- Volatility of Cryptocurrencies: The value of cryptocurrencies can be highly volatile. For example, Bitcoin has experienced dramatic price swings, which can impact the overall cost of your property if the value of your crypto assets drops significantly.

- Regulatory Landscape: While Dubai is crypto-friendly, regulations surrounding crypto transactions in real estate can still be complex. It’s important to work with a legal advisor and ensure that all transactions comply with UAE laws.

3. Financing with Cash

Paying cash for a property in Dubai remains a popular choice for many high-net-worth individuals (HNWIs) and international investors. A cash purchase eliminates the need for mortgages, interest rates, and monthly repayments, which can be appealing for investors seeking simplicity and peace of mind.

Why Investors Choose Cash Purchases:

- Simplicity and Speed: Cash transactions are faster, as they eliminate the need for mortgage approval and long paperwork processes. The property title can be transferred quickly, which is a significant advantage for those who need to finalize their investments promptly.

- No Interest Costs: By paying cash, investors can avoid paying interest on a mortgage, potentially saving a substantial amount of money over the life of the loan.

- No Debt Serviceability Concerns: Without a mortgage, there’s no need to worry about meeting monthly repayments or dealing with fluctuating interest rates.

Statistics on Cash Purchases in Dubai:

- According to the Dubai Land Department, 33% of property purchases in 2023 were made in cash, particularly in the luxury property sector.

- In prime locations like Downtown Dubai and Palm Jumeirah, cash purchases account for more than 50% of the total property sales.

Advantages of Paying Cash:

- Better Negotiating Power: Sellers often favor cash buyers as it guarantees a quick and guaranteed sale, which could lead to discounted prices or favorable terms.

- Immediate Ownership: Since there’s no need for mortgage approval or waiting periods, you can take full ownership of your property immediately.

Considerations:

- Lack of Liquidity: Using a large amount of cash to purchase property may reduce your liquidity, limiting your ability to access funds for other investments or emergencies.

- Opportunity Cost: By tying up your money in a property, you might miss out on other investment opportunities that could offer higher returns.

Conclusion:

Financing a property in Dubai offers multiple avenues, depending on your financial situation and investment preferences. Mortgages provide flexibility, especially for long-term investors. Cryptocurrency offers an exciting alternative but comes with high risks, while cash purchases offer a straightforward and often faster process, especially for those with substantial funds.

Regardless of which method you choose, Dubai’s real estate market continues to be an attractive option for both local and international buyers. By understanding your financing options and conducting thorough research, you can make a sound decision that suits your investment goals.