Dubai has solidified its reputation as a global real estate hub, attracting investors and homeowners alike with its tax-free benefits, futuristic developments, and high rental yields. One of the key decisions buyers face when entering the Dubai property market is choosing between off-plan properties and ready-to-move-in homes.

Each option comes with its own advantages and considerations. In this article, we will break down the differences, benefits, and risks associated with both so you can make an informed decision tailored to your goals.

What Are Off-Plan Properties?

Off-plan properties are units purchased directly from a developer before the property is completed. These projects may still be in the design phase, under construction, or close to completion.

Benefits of Buying Off-Plan in Dubai

- Lower Entry Costs: Off-plan properties in Dubai are generally priced more competitively compared to ready properties. This makes them appealing to first-time investors or buyers on a tighter budget.

- Flexible Payment Plans: Developers offer attractive and staggered payment plans, including post-handover options. For example, you might pay 10% as a down payment, with the rest spread across construction milestones and beyond.

- Buy Low, Sell High: One of the biggest advantages? You can buy early at a lower price and resell later at a significantly higher price once the project is complete or the area appreciates. Many investors use this strategy to maximize capital gains.

- Capital Appreciation: By the time construction is complete, your property may have appreciated significantly in value. Early investors can enjoy substantial returns.

- Modern Features & Customisation: New developments are designed with the latest trends in mind, such as smart home tech, sustainable materials, and community living. Some developers even allow limited customization on layouts and finishes.

Considerations and Risks

- Delays & Construction Risks: Completion dates may be extended, and the final product may differ slightly from what was promised.

- No Immediate Rental Income: You’ll need to wait until the property is completed to generate rental returns.

- Reputation of Developer: Due diligence is crucial. Only invest in off-plan properties from developers with a solid track record and financial stability.

What Are Ready-to-Move-In Properties?

Ready properties are completed and available for immediate occupancy or rental. Buyers can inspect the property before purchase and even start furnishing or renting out the unit the same week.

Benefits of Ready Properties in Dubai

- Immediate Possession: Perfect for buyers who want to live in their new home right away or start earning rental income from day one.

- You Get What You See: No surprises. You can walk through the actual unit, inspect the finishes, and assess the surroundings before committing.

- Easier Financing: Banks are more likely to approve mortgages for completed properties. Additionally, loan-to-value ratios are more favorable.

- Qualify for Residency: Purchasing a ready property worth AED 750,000 or more may make you eligible for a UAE residency visa, an attractive perk for expats.

Considerations and Risks

- Higher Upfront Costs: Compared to off-plan, ready properties tend to be more expensive.

- Lump Sum Payments: You may need to pay a larger portion upfront, especially if you’re not financing through a bank.

- Older Finishes or Wear & Tear: While many properties are well-maintained, some may require renovations or touch-ups.

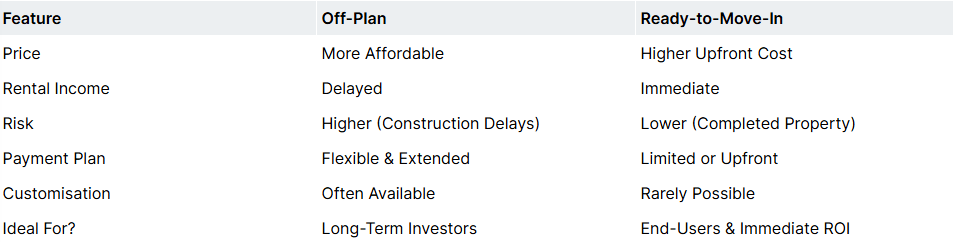

A Summary Comparison between the 2

Which Option Is Right for You?

Choose Off-Plan if:

- You’re looking to invest for long-term gains.

- You want to buy low and sell high.

- You want lower prices and flexible payments.

- You’re not in a rush to move in or earn rental income.

Choose Ready-to-Move-In if:

- You’re buying for personal use and want to move in quickly.

- You want to start generating rental income immediately.

- You’re seeking financing through a local bank.

Conclusion

Dubai’s property market has something for every type of buyer, whether you’re an investor eyeing strong returns or a homeowner looking for a dream lifestyle. Buying off-plan allows you to enter the market at a lower price, with the potential to cash out with higher resale value later. Meanwhile, ready properties give you the advantage of immediate usage and rental returns.

If you’re unsure where to start, let Avarten Real Estate guide you. We specialize in both off-plan and ready-to-move-in options across Dubai and work directly with top-tier developers, offering transparent advice, flexible support in multiple languages, and tailored investment strategies.

Ready to explore Dubai real estate?

Connect with Avarten Real Estate today, your trusted partner in Dubai’s booming property market.