Dubai Property Market 2025: Tax-Free Returns, Easy Cross-Border Deals, and Residency on the Table

Introduction: From Warsaw to the Waterfront

With Poland’s economy cooling, local taxes rising, and the złoty facing currency swings, many high-net-worth individuals and savvy retail investors are looking beyond Polish borders for growth. Dubai, the Middle East’s powerhouse of zero income tax, luxury infrastructure, and investor-friendly laws, has emerged as the standout alternative.

Below, we break down exactly why more Poles are redirecting their capital to the UAE and how you can join them.

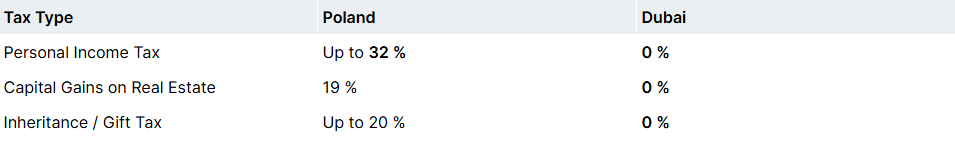

1. Tax Advantages You Won’t Find in the EU

Keep 100 % of your rental profit and resale gains.

- No wealth tax, no stamp duty, and no capital-repatriation limits.

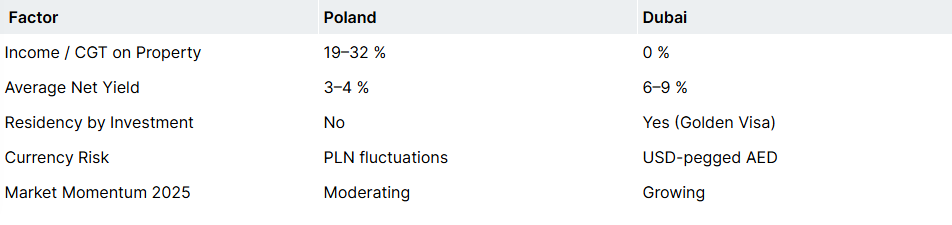

2. High Rental Yields & Strong Demand

- 6–9 % net yields in prime areas such as Business Bay, Dubai Marina, and Dubai Hills, far higher than Warsaw’s 3–4 %.

- Year-round demand from expats, tourists, and remote workers ensures minimal vacancy.

3. Golden Visa & Residency Perks

Invest AED 2 million (≈ PLN 2.1 million) in property and secure a 10-year UAE Golden Visa for you and your family:

- Multiple re-entry, no sponsor needed.

- Access to local banking, schools, and healthcare.

- Perfect Plan B amid EU economic uncertainty.

4. Hassle-Free Cross-Border Purchasing

- Remote Viewings: High-definition video tours and live walkthroughs.

- E-Signed Contracts: All documents completed online, in English.

- Escrow Protection: Funds held in government-regulated escrow accounts.

- Fast Transfer of Ownership: Digital title deed issued by the Dubai Land Department.

5. Currency Stability

The UAE dirham is pegged to the US dollar, shielding your investment from złoty volatility and giving you a dollar-denominated hedge.

6. Developer Incentives & Flexible Payment Plans

- 10 % down with post-handover plans up to 5 years.

- Furnishing packages, service-charge holidays, and rental guarantees available on select launches.

Quick Comparison: Poland vs. Dubai

Is Dubai Right for You?

Choose Dubai if you want:

- Tax-free rental income and capital gains.

- A stable, USD-pegged currency hedge.

- Long-term residency options for your family.

- Double-digit appreciation potential in a global gateway city.

Conclusion

Dubai offers Polish investors something Warsaw simply can’t: tax neutrality, higher returns, and a pathway to residency in a booming, investor-friendly market. Whether you’re diversifying your portfolio or planning a financial safety net, the time to act is now while prime units and developer incentives are still available.