As global economies continue to adapt post-pandemic and in the face of rising interest rates and inflation, real estate remains a favored asset class for wealth preservation and growth. Two cities that dominate the global real estate investment conversation in 2025 are Dubai and New York. Both offer unique advantages and carry distinct investment profiles. But when it comes to Return on Investment , where should smart investors focus their attention?

In this article, we offer a comparative breakdown of Dubai and New York to help you make an informed decision, especially if you’re considering buying property through a real estate agency in Dubai or comparing offerings from the top real estate companies in Dubai.

1. Property Prices and Entry Barriers

Dubai continues to offer one of the most attractive price-per-square-foot metrics among global metropolitan cities. In prime areas like Business Bay, Dubai Creek and Dubai Hills, prices range from AED 1,300 to AED 2,500 per sq. ft., offering significant value. Whether you’re looking for Dubai apartments for sale or want to buy off-plan property in Dubai, the entry costs remain far more affordable than many Western counterparts. In contrast, New York, particularly Manhattan, commands an average price of over USD 1,500 per sq. ft., making it one of the most expensive property markets globally.

Factor in closing costs, maintenance fees, and property taxes, and the initial investment becomes considerably higher.

Winner: Dubai – Lower entry costs and flexible payment plans from the best real estate agency in Dubai, make it accessible for a wider range of investors.

2. Rental Yields

Rental yields are a critical component of ROI. Dubai consistently outperforms in this area. In 2025, investors are enjoying gross rental yields between 6% to 8%, especially in popular communities like Downtown Dubai, JVC, and Dubai Hills Estate. With many new off plan projects in Dubai hitting the market, rental demand is soaring. New York yields, while stable, are modest, typically 2% to 3.5% gross. High operational costs and property taxes eat into net returns.

Winner: Dubai – Stronger gross and net rental yields, particularly from the best off plan projects in Dubai.

3. Capital Appreciation Potential

Dubai’s real estate market has seen remarkable appreciation in recent years. In 2025, continued economic diversification, the Expo City transformation, and long-term vision initiatives are boosting market performance. Capital appreciation of 5% to 8% is expected in key developments. New York remains steady but slower, with expected appreciation between 1% to 4% annually. It’s more of a long-term growth market.

Winner: Dubai – Greater upside in a shorter time frame, especially in off plan luxury developments.

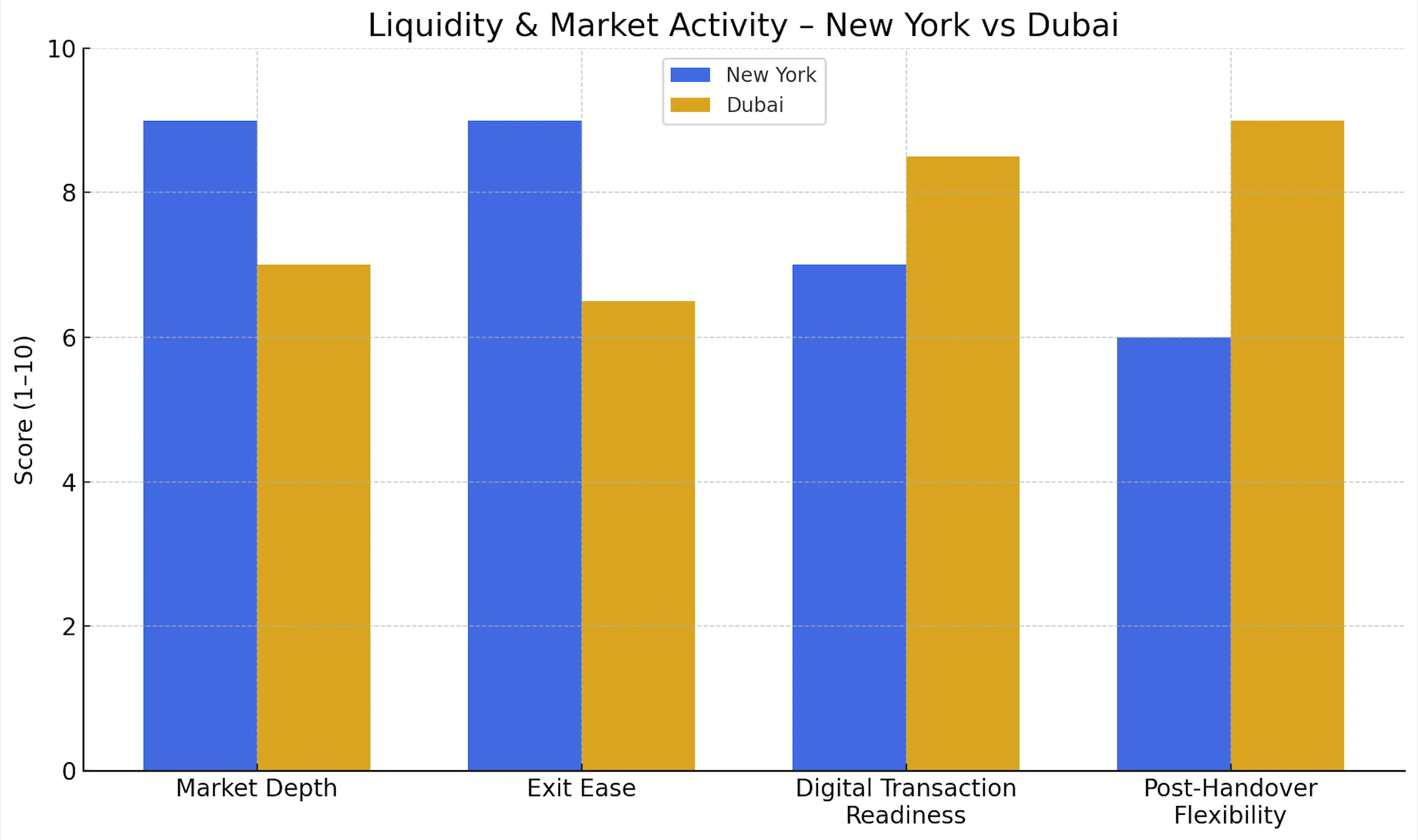

4. Liquidity and Market Activity

New York’s market is deep and liquid with strong institutional investor interest. It’s easier to exit investments quickly in hot neighborhoods. Dubai’s liquidity has improved thanks to digital property platforms and relaxed ownership rules. Buyers can now transact remotely, and developers are offering investor-friendly post-handover plans.

Winner: New York – Slightly more liquid, but Dubai is catching up fast thanks to innovation from the top real estate companies in Dubai.

5. Tax Implications

One of Dubai’s greatest investor benefits is its tax-free environment. No income tax, capital gains tax, or property tax, dramatically boosting ROI. Moreover, investing in property allows foreigners to apply for long-term residency. If you’re wondering how to get a Golden Visa or how to apply for a Golden Visa, property investment is one of the easiest routes. In contrast, New York investors face income tax, property tax, and capital gains tax, which significantly reduce net returns.

Winner: Dubai – Tax advantages plus residency benefits make it a clear winner for savvy global investors.

6. Ownership Laws and Ease of Doing Business

Dubai offers 100% foreign ownership in designated freehold zones. Regulations are transparent, and platforms like Dubai REST have streamlined the buying process. Whether you’re a first-time buyer or an institutional investor, working with a real estate agency in Dubai can make the process smooth and secure. New York allows foreign ownership but comes with strict compliance, high closing costs, and difficulty in securing financing as a non-resident.

Winner: Dubai – Simple, investor-friendly framework backed by the best real estate agency in Dubai.

Final Verdict: Dubai or New York in 2025?

If your priority is strong rental income, capital appreciation, low taxes, and even a potential Golden Visa, Dubai is the clear winner in 2025. With world-class infrastructure, continuous government reforms, and a booming off-plan sector, Dubai has evolved into a global investment hotspot.

New York, while stable and prestigious, suits conservative, long-term investors willing to accept lower yields for global exposure and liquidity.

Looking to Invest in Dubai?

At Avarten Real Estate, one of the top real estate companies in Dubai, we help you explore the best off-plan projects in Dubai, secure prime Dubai apartments for sale, and even guide you on how to get Golden Visa through property investment. Whether you’re a first-time buyer or an experienced investor, trust the best real estate agency in Dubai to maximize your ROI in 2025.