As retirement planning becomes more critical for individuals across the globe, mature investors are increasingly turning their attention toward the United Arab Emirates (UAE). With its tax-free environment, strong property laws, long-term residency options, and high return on investment (ROI), Dubai in particular stands out as an ideal destination for retirees seeking stability and financial growth. This article explores why investing in Dubai real estate is a smart retirement strategy, supported by statistics and key insights into the market’s performance.

Why the UAE is Attractive for Retirement Planning

- Zero Income Tax:

One of the UAE’s most compelling advantages is its zero personal income tax policy. Unlike in many Western countries where retirees must factor in pension and social security taxes, Dubai offers a tax-free retirement environment. This means that retirees can enjoy 100% of their pension income without deductions. For example, a retiree receiving €30,000 per year in pensions in Germany may only take home about €24,000 after taxes. In Dubai, the full €30,000 remains intact, significantly enhancing disposable income and long-term financial security. - High Rental Yields:

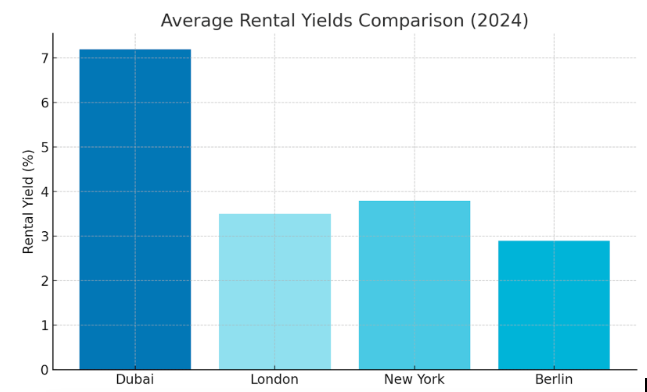

Dubai consistently ranks among the top global cities for rental returns. According to data from Property Finder and Bayut, average gross rental yields in Dubai ranged from 6% to 8% in 2024, with prime areas such as JVC, Business Bay, and Dubai Marina offering returns as high as 9%. In contrast, mature markets like London (3.5%), New York (3.8%), and Berlin (2.9%) offer considerably lower yields. This enables retirees to generate a steady and inflation-resistant stream of passive income, supplementing their pensions while preserving capital value. - Golden Visa for Long-Term Residency:

The UAE offers a 10-year renewable Golden Visa for property investors who invest a minimum of AED 2 million (approximately €500,000). This visa allows long-term residency for the investor and immediate family members, including spouse and children. Benefits include unrestricted entry/exit, no local sponsor requirements, and eligibility to open bank accounts and lease properties. For retirees, this means long-term peace of mind and the freedom to live in a tax-free, safe, and luxurious environment without worrying about frequent visa renewals or legal uncertainties.

Dubai Real Estate: A Market Built for Growth

- Property Value Appreciation Over the past decade, Dubai’s real estate market has demonstrated resilience and upward momentum. According to Dubai Land Department data, property prices grew by 18% year-on-year in 2023 alone, particularly in areas like Dubai Marina, Downtown Dubai, and Business Bay. This presents a strong opportunity for capital appreciation over the medium to long term.

- Off-Plan Property Investment Retirees can benefit from flexible payment plans and lower entry points through off-plan projects. Developers like Emaar, Sobha, Damac, and Binghatti offer installment-based plans with post-handover payment options, making it easier to manage finances during retirement.

- Stable and Regulated Market Dubai’s real estate sector is regulated by the Real Estate Regulatory Authority (RERA), which ensures transparency, legal protections, and accountability. This offers peace of mind to international investors, particularly retirees seeking security.

Graph 1: Average Rental Yields Comparison (2024)

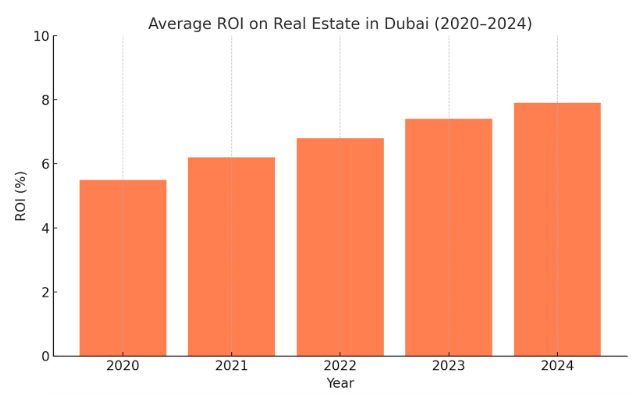

Graph 2: Average ROI on Real Estate in Dubai

Lifestyle Benefits in Dubai for Retirees

- World-Class Healthcare Dubai boasts a highly developed healthcare system, ranked 22nd globally by Numbeo’s 2023 Health Care Index. With access to state-of-the-art hospitals and English-speaking professionals, retirees can receive excellent medical care.

- Safe and Secure Environment The UAE consistently ranks among the safest countries globally, with a low crime rate and high levels of public safety. This is crucial for retirees who prioritize peace of mind and well-being.

- Luxury and Leisure Amenities Dubai is home to an unmatched lifestyle offering — from fine dining and cultural events to luxury malls, golf courses, and waterfront living. Whether you seek relaxation or activity, Dubai caters to every preference.

Case Study: German Couple Investing for Retirement Stefan and Claudia, a retired couple from Munich, invested in a two-bedroom apartment in Dubai Hills Estate in 2022. The property cost AED 2.1 million (€530,000), qualifying them for the UAE’s Golden Visa. They now lease the property for AED 140,000 per year (€35,000), achieving a rental yield of over 6.6%. The property value has appreciated by 12% since purchase. They visit Dubai each winter and enjoy a secure, tax-free lifestyle.

Conclusion: A Strategic Move for Financial Freedom Investing in Dubai real estate as a retirement strategy offers unparalleled advantages: high rental income, capital appreciation, long-term residency through the Golden Visa, and a tax-free environment. With regulatory support, global connectivity, and a luxury lifestyle, Dubai is not just a vacation hotspot, it’s a destination where retirement dreams come true. Whether you’re planning to diversify your portfolio or secure your retirement in a thriving international hub, Dubai real estate should be at the top of your strategy list.